The Discipline Behind the Numbers: Why Stability Is the New Alpha

Conventional wisdom says investing is all about compromise. If you want the upside of equities, you must live with volatility. If you want safety, you accept muted returns. But the past decade has shown that this isn’t the only path.

As Warren Buffett wisely stated , “The first rule of investment is don’t lose money” and the second is “Never forget the first rule”. At Garrington, that principle has been central to how we’ve built and managed the Garrington Private Credit Strategy. Over the past decade, our experience has shown that disciplined lending, secured by real assets and guided by a risk-first mindset, can deliver attractive returns without exposing investors to the kind of drawdowns that often come with public markets.

A Decade of Steady Performance

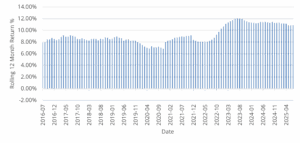

When I meet with investors, I like to start with a simple chart: the Garrington Private Credit Strategy’s rolling 12-month returns since inception. Over the last ten years, those returns have consistently averaged between 7% on the downside and 12% on the upside.

In other words, the strategy has demonstrated the ability to deliver equity-like outcomes while significantly reducing the probability of severe drawdowns.

That kind of consistency is rare. Equity markets can swing sharply on the back of a headline. Traditional fixed income markets, once considered safe havens, have been rattled by rising interest rates and liquidity squeezes. In contrast, our approach has been defined by measured performance across economic cycles.

The Reality Behind the Track Record

No investment strategy is flawless, and we don’t pretend otherwise. Losses have occurred in almost every year of this track record, averaging about 65 basis points per annum. At times, those losses may cluster, nudging returns closer to the lower end of our range. But here’s the critical distinction: the resilience of our structure and process makes a negative 12-month period highly improbable.

That confidence isn’t rooted in optimism; it’s rooted in discipline. Every transaction we underwrite is “boxed”, designed with controls, collateral, and monitoring mechanisms that mitigate risk before it ever reaches investors. It’s a practice built not just on financial modeling, but on the experience of deploying over $6 billion across thousands of loans since 1999.

Why We Don’t Chase Scale

There’s a temptation in private markets to equate size with success: bigger deals, bigger headlines, bigger numbers. At Garrington, we’ve chosen a different path. Our firm wasn’t built to be the biggest lender in North America. It was built to be resilient. That means focusing on first-lien, senior secured positions, which today make up 99% of our loan portfolio (as of June 30, 2025), and maintaining a conservative weighted average LTV of approximately 65%.

It also means having the discipline to pause, decline transactions that don’t meet our standards, or even return capital when conditions suggest restraint is the smarter move. For us, growth at any cost is not the goal. Protecting investor capital is.

Transparency: Looking Under the Hood

One more point that I always emphasize: a track record, on its own, is virtually meaningless. Numbers are just the cover of the book; you need to read the pages to understand the whole story. That’s why we invite every potential investor to conduct

their own due diligence, review our portfolio, and see as much detail as they need. Our team, spanning origination, underwriting, and portfolio management, is open and accessible, as transparency fosters trust.

Everyone wants a crystal ball. We’d rather rely on collateral

The Takeaway

Markets will keep shifting through cycles, sometimes with enthusiasm, sometimes with fear. What matters is not predicting the next turn but being prepared for it.

At Garrington, we’ve built a strategy around resilience: asset-backed structures, first-lien protection, and disciplined loan selection. Transparency is just as essential — because while returns are what matter most, they’re only sustainable if you understand the risks behind them.

That’s why we invite investors to look under the hood and see the discipline driving our portfolio. Our philosophy is clear: the best way to win is by not losing.