Staying Disciplined in a Competitive Market – Garrington’s Perspective on “The Battle for the Borrower”

A recent piece by Matt Savino, Global Head of Capital Markets at The Carlyle Group, titled “Battle for the Borrower”, explored what the author sees as a growing rivalry between private credit lenders and the broadly syndicated loan (BSL) market. The article argues that as deal activity rebounds, both markets are increasingly willing to offer more aggressive terms, which Savino interprets as a potential loosening of underwriting standards.

As the piece highlights, this surge in competition is happening against a backdrop of rising M&A activity. Reports from PwC and Ropes & Gray show that deal value in the Americas climbed roughly 25 percent in the first half of 2025, with sponsor-backed transactions reaching nearly 300 billion dollars in September alone. With more deals coming to market and significant capital still waiting to be deployed, borrowers are in a strong position to negotiate favorable pricing and structures. It has quickly become what many describe as a borrower’s market.

Against this backdrop, traditional public loan markets are offering cheaper pricing and higher leverage to regain ground that private credit captured during the years of volatility and rising interest rates. Private credit, meanwhile, continues to emphasize speed, flexibility, and partnership. For borrowers, this competition has created an environment of attractive terms and easier access to capital.

Yet for lenders, the article highlights a familiar crossroad (the 2019 to 2021 period was also full of our competition loosening standards). When competition intensifies, the pressure to relax standards in pursuit of new deals often follows.

At Garrington, we believe this is the moment when discipline matters most.

That long-term mindset defines our approach to private credit. While others may adjust their thresholds to keep capital moving, Garrington remains anchored to a consistent strategy designed to protect investors and support sustainable performance.

Our standards do not shift with market cycles. We focus on:

- Good quality collateral that is valued at liquidation levels and further discounted through conservative advance rates.

- Holding senior lien positions on collateral as well as security over the broader business assets.

- Understanding the business through detailed due diligence on its operations, performance, and capital needs.

- Assessing financial performance and risk with clear-eyed objectivity.

“When faced with growing competition in a tighter market, it’s easy to fall into a trap of relaxing standards or criteria to secure a win on a new opportunity. At Garrington, we think about the long game as opposed to a quick win. Securing good quality transactions in the right way helps to secure a strong performing portfolio better, and that’s where we like to be.”

— Erica Axani, Executive Vice President and Chief Risk Officer

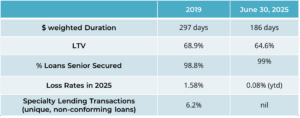

An analysis of our portfolio in 2019 as compared to today supports these statements:

Our pipeline is constantly rotating and, as we decline the majority of transactions we see, we must always maintain a constant flow of new opportunities in order to be able to select those that fit our criteria, maintaining our close percentage at around 4-6%.

While important to have a robust and ever-revolving pipeline, it is even more important to have an inflow of opportunities that fit our verticals and resemble transactions that are do-able. Therefore, we do not overly focus on the number of potential transactions but the conforming nature of them, of which we are seeing an ever-increasing number today.

This is a result of continued work with our network of referral partners, educating them on our verticals and lending parameters, and better honing their skills in being able to pre-qualify or immediately decline opportunities that work or do not work.

Current pipeline statistics include:

- Approximately $500 million in new opportunities

- $64 million in transactions in active diligence or advanced proposal

- The breakdown of active opportunities are allocated 43% to Lender Finance, 38% to ABL, and 19% to Factoring

We continue to invest significant time understanding our potential clients and their businesses. That understanding allows us to become true partners who can support them through both good times and challenging periods.

Competition is healthy. It fuels innovation and provides borrowers with more options. But in private credit, success is not measured by speed or size alone. It is measured by the quality of the portfolio, the protection of investor capital, and the consistency of results through changing conditions.

At Garrington, we remain committed to lending wisely, securing strength, and partnering with integrity.