Lending Series | Part 5: Real-World Lender Finance in Action

Last week, we shared an overview of Lender Finance — a lending vertical where we provide senior revolving lines of credit secured by the loan portfolios of finance companies. This week, we’re continuing the conversation by bringing it to life.

We often say that experience is everything in this space. Underwriting a lender and their portfolio requires deep credit skills, operational insight, and hands-on involvement. The following two examples illustrate how we apply this discipline across very different markets and are representative of the well-managed, secured transactions that anchor our lending strategy.

Example 1: Mortgage Lender for Recreational Properties

Location: USA

Facility Type: Senior Secured Line of Credit

Collateral: First mortgages on U.S. and Canadian-owned properties outside of North America

This transaction supports a U.S.-based company that lends to North American individuals purchasing residential real estate abroad. The company identified a growing market where traditional financing remains limited, offering a compelling opportunity to meet demand with a secured structure.

A third-party appraised property backs each loan, and overall low loan-to-value on a portfolio wide and appraised individual property. Titles are securely held via an independent agent, and servicing is managed externally to ensure operational oversight.

Loan durations are typically under seven years, and prepayments are common due to refinancing activity. Low delinquency and strong repayment behavior reflect both borrower quality and the company’s proactive credit management. This transaction exemplifies our focus on niche, asset-backed opportunities with experienced operators and strong underlying collateral.

Example 2: Auto Lender

Location: USA

Facility Type: Senior Secured Revolving Facility

Collateral: Performing used vehicle loans.

This financing supports a U.S.-based company that focuses on vehicle lending to borrowers who rely on their vehicles for income-generating purposes. The company serves a specialized segment of the auto lending market and maintains a targeted distribution strategy through longstanding relationships with select dealerships.

What makes this opportunity compelling is the operator’s experience, underwriting discipline, and consistent loan performance. Many of the borrowers have limited credit histories but demonstrate strong repayment behavior, particularly with prior vehicle financing.

The loan portfolio is closely monitored through frequent reporting and periodic on-site reviews, providing us with meaningful insights into asset quality and performance trends. Credit losses remain below industry benchmarks, reflecting the company’s conservative lending approach and deep familiarity with its borrower base.

Why This Matters

These examples are very different — one supports recreational real estate, and the other helps small businesses stay on the road. But both represent the core principles of our Lender Finance strategy:

- First-lien senior secured positions.

- Well-diversified, cash-generating portfolios.

- Operators with experience, infrastructure, and integrity.

- Transparent reporting and ongoing oversight.

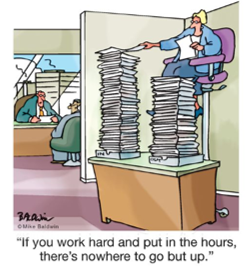

They also reflect something more important: our willingness to do the work. To ask the hard questions, structure deals with intention, and stay close to the underlying performance long after capital is deployed.