Private Lending

An Attractive Fixed Income Solution

Investors are challenged to attain attractive yields from traditional fixed-income assets. Private Lending may offer attractive solutions for yield and returns.

Benefits of Private Lending Investing

- Strong historical return and cash flow characteristics relative to other fixed income vehicles.

- Solid focus on preservation of capital.

- Lower leverage ratios, greater asset coverage and stronger covenant typically than more liquid loan market.

- Market inefficiencies have the potential to translate into higher yields for investors.

- Low historical correlation to equity and bond markets.

- Private loans, not market priced (minimal market volatility as compared to public equities and bonds).

- Illiquidity Premium – for those investors that do not need the immediate liquidity of public markets, a premium is typically provided.

Private Lending Advantages Capital Stack

| HIGHEST SECURITY |

| Senior Secured Debt Garrington’s Investment Focus |

| Unsecured Debt |

| Mezzanine Debt |

| Senior Secured Bonds |

| Junior Secured Bonds |

| Junior Unsecured Bonds |

| Preferred Equity (Preferred Stock) |

| Equity (Common Stock) |

| LOWEST SECURITY |

Garrington's Investment Focus

- The relationship between each investment type and its position on the priority repayment ladder, shows the higher up one's investment is on the capital stack the more secured their priority payback position is.

- Priority claim diminishes as the stack moves down, causing ones investment risk to increase.

- Garrington primarily focused on loans which are senior secured in nature.

Private Lending Advantages Over Traditional Fixed Income Vehicles

| Why it matters | Private Credit | Leveraged Loans | High Yield Bonds | |

| Privately Negotiated | Directly negotiate fees, covenants, and other attractive terms with borrower | |||

| Floating Rate | Coupons may increase with rising interest rates | |||

| Senior Secured | Priority in repayment which can provide greater capital protection | |||

| Direct Collateral | The direct underlying collateral is secured in a senior position | |||

| Not Publicly Traded | Valued on the fundamentals; not subject to mark-to-market volatility |

Garrington sets its own terms vs buying a bond or fixed income vehicle whereby someone else sets the terms.

SME’s are crucial for the economic growth and competitiveness of any country. In OECD countries, SMEs account for about 99% of firms and 70% of all jobs. They also contribute over 50% of GDP in high-income countries worldwide.

Source: Mckinsey & Company Beyond Financials: Helping small and medium-sized enterprises thrive, January 2022.

Market Dynamics

Asset-backed lending strategy capitalizes on the opportunities created by a decline in bank lending and the heightened regulation imposed on them, while the demand for small and middle market business financing continues to grow.

Commercial banking businesses in the US in 2022 decreased to 4,453 business from 6,072 businesses in 2012, a decrease of 2% from 2021 and 27% since 2012.

Projected growth of commercial banking in 2012 is only 0.2%.

Source: IBIS world, 2022.

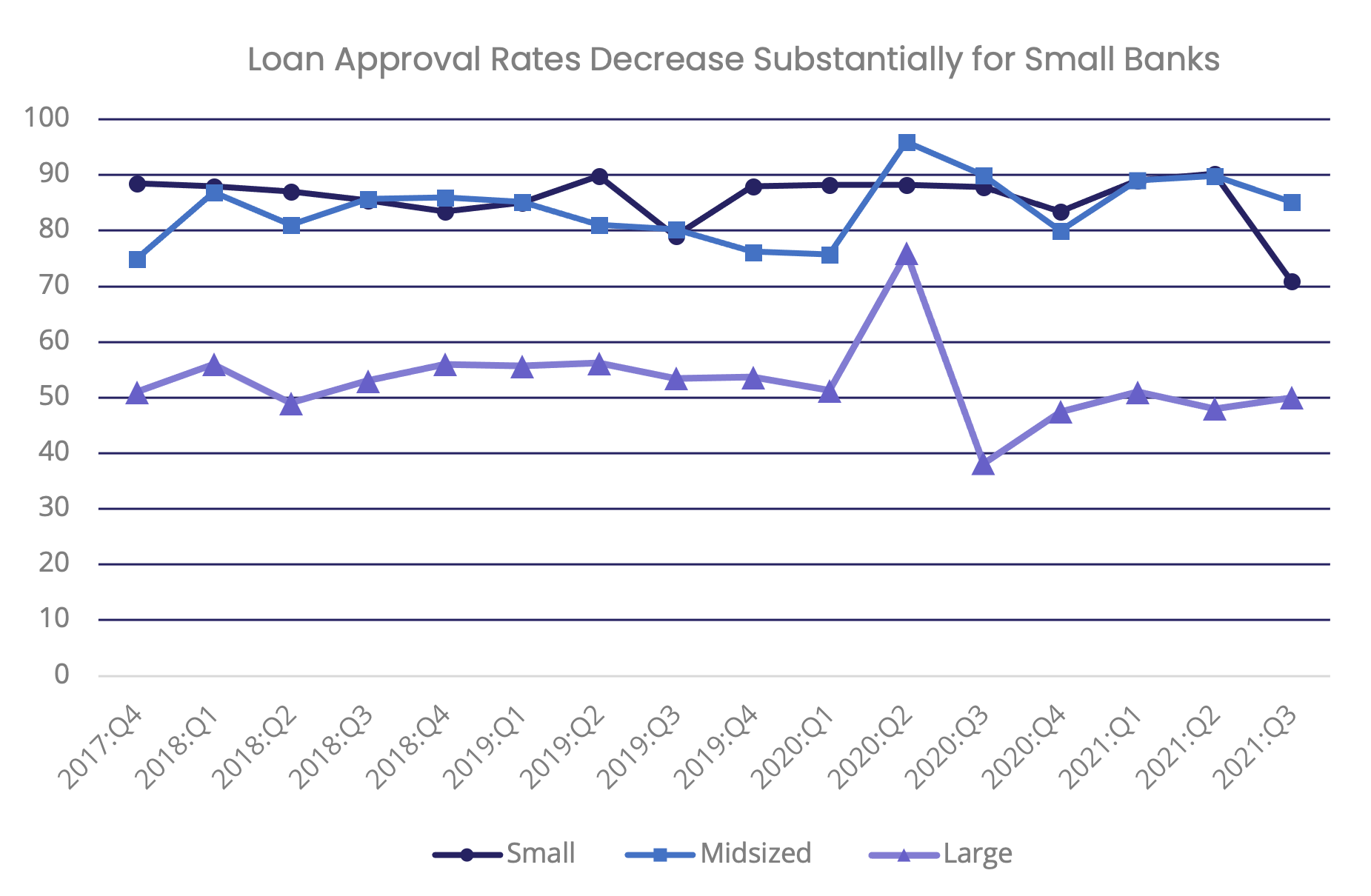

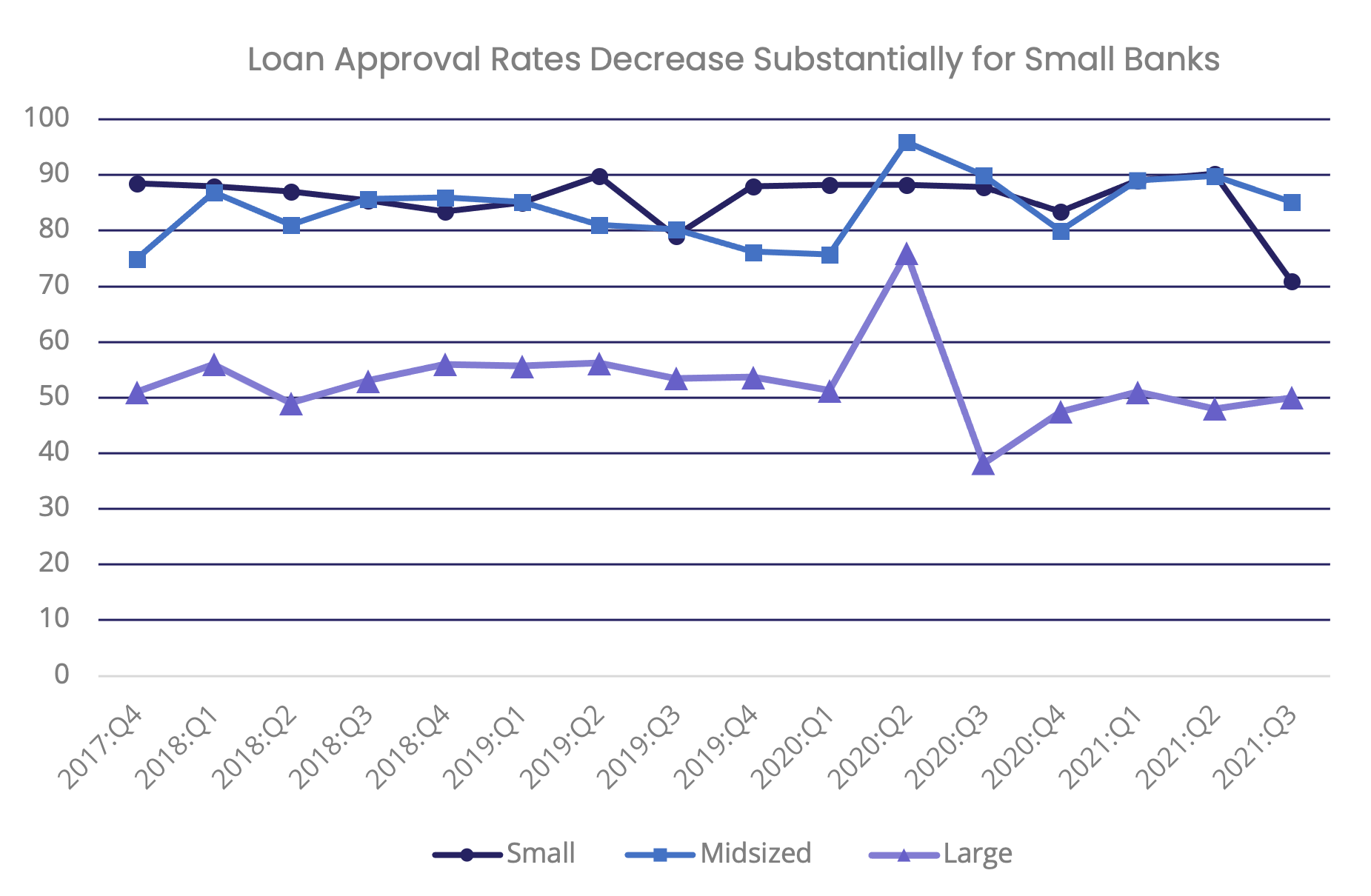

Continuing Decline in Banking

Small business lending approval rates at small banks decreased from 91 percent in the second quarter to 71 percent in the third quarter of 2021, the lowest level since 2017, while approval rates for midsized and large banks increased.

The three most cited reasons for denying a loan for all bank sizes were borrower financials, credit history and collateral.

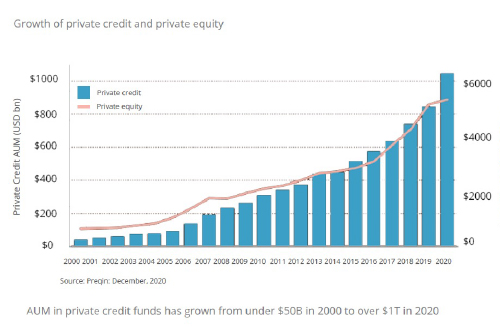

Private debt industry is a strong growing asset class that provides diversification for investors while providing critical funds to businesses.

Rapid Growth of Private Lending

Garrington's Investment Focus

- Direct Lending accounted for nearly 60% of overall private debt fundraising in 2021. Exceeding $100 billion for the first time.

- It has accounted for 73% of the overall growth in private debt fundraising over the past decade, growing nearly 50% per annum.

- Direct lending can generate higher yields and has not, to date, experienced onerous loss rates.

Source: McKinsey Global Private Markets Review, 2022.