What’s Beneath the Surface: A Closer Look at How We Lend

Transparency is often promised but rarely practiced. At Garrington, we aim to be the exception not just because it’s good investor relations, but because we believe trust compounds, just like returns.

In our latest investor call, we opened the curtain on some of the larger facilities within our portfolio. While each position is senior secured and part of a broadly diversified strategy, it’s worth taking a moment to walk through a few examples that help define how we think about risk, yield, and structure.

Lending to a Lender

One of our longest-standing investments, a $29 million facility, goes to a firm that operates in our world. They provide factoring and asset-based loans to over 100 small businesses. In our books, this counts as a single facility. But under the hood it is a portfolio of factoring and ABL loans, this portfolio is widely diversified.

Their underwriting and portfolio management team is led by seasoned professionals. The ownership team is experienced lenders who have been in the trenches for years working hard to build their business.

This deal works because we think alike, good credit decisions and key to a string portfolio. When they share their underwriting packages and the rationale for their credit decisions, we are often aligned.

We also hold additional security beyond the underlying collateral: a mortgage on their headquarters and personal guarantees backed by real estate. This isn’t just about trust, it’s about enforceability, layered risk protections that work together like gears in a well-built watch.

Financing for Title Loans in California

Another holding: a $10 million lender finance facility, supports a U.S.-based title lender.

Our exposure is directly tied to a well-performing portfolio that has been growing steadily. We recently upsized the facility following consistent performance.

The risk is diversified across more than 1000 loans.

We base our advance rates on the principal balance of the loans; however, the monthly repayments include principal and interest, therefore the repayment of our loan to this lender is accelerated due to the blended payments.

Cross-Border Mortgages… in Mexico

Yes, you read that right. We finance a Canadian and U.S. lender that provides mortgages for vacation homes in Mexico. The structure is sound: each loan is backed by appraised residential property, and legal title is held by a local fiduciary agent. In the event of default, recovery is efficient and predictable.

While the loans may be set up to amortize over several years, generally the loans are repaid much faster as the borrower refinances the loan utilizing personal resources.

Why We Share This

You might be wondering: why reveal these kinds of details?

Because in a market full of opacity, we believe discretion and transparency can co-exist. While we protect proprietary aspects of our underwriting and deal sourcing, our investors deserve to understand what their money is doing, not just in terms of headline yield, but structure, security, and strategy.

We believe risk is best mitigated through clarity and discipline. That’s why we lift the hood, and let you see more deeply into the engine.

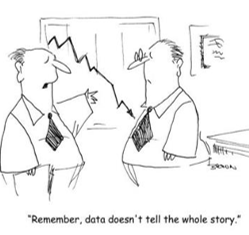

The numbers are just the headline. The real story is in the footnotes

From the Outside In

Each of these examples reflects the broader principles that shape the Garrington portfolio:

- 99% of our portfolio is senior secured

- We prioritize short-duration, current-paying loans

- Risk is never evaluated in isolation, we consider the borrower, the business model, and the market context.

That’s the Garrington edge. Built with intent, not instinct.

And if you’re still wondering whether boutique means small, just remember depth, not breadth, is often where the real strength lies.