Introducing Our Investment Philosophy: The Four Pillars of Strength

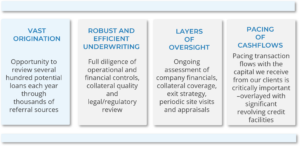

Private credit is a dynamic, ever-evolving space, and standing out requires more than a competitive edge—it demands a disciplined investment philosophy built on unshakable foundations. Our firm has distilled our approach into four core pillars of strength, each of which plays a critical role in delivering consistent, uncorrelated returns for our investors.

Over the next four entries in this blog series, we’ll examine these pillars in depth, sharing insights into how they guide our strategy and why they matter.

Garrington Investment Philosophy – Garrington Four Pillars of Strength

Private lending to SME businesses in North America, primarily in loan sizes under USD $30 million can provide excellent risk adjusted returns relative to other asset classes WHEN MANAGED APPROPRIATELY.

The First Pillar: Vast Origination

We begin with what we believe is the cornerstone of our success, Vast Origination.

In private credit, success often comes down to one simple yet powerful concept: choice. The “luxury of choice” allows Garrington to thrive in an environment where flexibility, discipline, and opportunity converge. At the heart of this lies a vast origination network, a vital differentiator that empowers us to be strategic rather than reactive. In a world where the best opportunities aren’t always the most obvious, having access to a wide array of deals is more than an advantage; it’s necessary.

The Advantage of a Robust Origination Network

“We have to kiss a lot of frogs…”

Our origination network delivers a constant flow of opportunities every month, providing us with unparalleled choice.

This vast deal flow allows us to remain disciplined and agnostic, focusing on what the market gives us rather than chasing trends. It ensures we can identify and act on the right opportunities while protecting investor capital through thoughtful selection and diversification. A strong origination network provides the following key benefits:

- Diverse Deal Flow

By tapping into a vast network of referral sources, we receive opportunities spanning various industries, geographies, and borrower profiles. This allows us to maintain an agnostic stance toward deal types. Whether it’s factoring, asset-based lending, or other types of senior secured loans, we can evaluate each opportunity on its own merits without bias or the pressure to chase trends. - Market Resilience

Chasing the market is a trap for many. By contrast, having abundant deal flow means we don’t have to accept too much risk or compete aggressively for a narrow pool of opportunities. Instead, we let the market come to us, picking the best from its offers. This disciplined approach ensures we maintain strong credit fundamentals, even in challenging economic environments. - The Power to Say “No”

The true luxury of choice is the ability to say “no” more often than “yes.” With hundreds of deals in the pipeline, we can afford to be selective, focusing only on opportunities that align with our risk tolerance and return objectives. This deliberate process safeguards both capital preservation and performance consistency.

Our Referral Network: The Backbone of Vast Origination

At the heart of our vast origination lies a powerful referral network of over 20,000 professionals across North America. This network includes:

- Accountants,

- Attorneys,

- Business brokers,

- Commercial bankers,

- Factors that agent ABL or equipment deals,

- Financial planners,

- Investment banks,

- M & A advisors,

all critical in sourcing the high-quality opportunities that fuel our private credit strategy. These trusted professionals are the eyes and ears on the ground, connecting us to businesses across industries and geographies. Their expertise, relationships, and market insights are indispensable to our success, ensuring we remain at the forefront of deal flow while maintaining the flexibility to select only the best opportunities for our investors.

By the Numbers: Breaking Down 2024

No matter the number of opportunities sourced, we maintain that an average close rate of 8-12% is the target, and 2024 was no different. Of all the prospective clients to cross our threshold, here is where they landed:

- Over 80% of all sourced opportunities were reviewed by underwriting in-depth;

- Of the reviewed transactions, we proposed on approximately 20%;

- Of those we proposed, we closed and funded over 60%;

- Overall, we funded about 10% of the opportunities sourced.

This shows how drastically our process cuts down the potential clients from the review stage and throughout.

It also indicates that the majority of what we propose on, we win.

This is a testament to our team’s ability to pinpoint good, quality transactions effectively and to show ourselves as a good solution to potential borrowers.

Conclusion: Mastering the Market by Mastering Choice

At Garrington, the game isn’t about chasing opportunities; it’s about positioning yourself to choose the best ones. Backed by hundreds of years of combined experience and a proven track record since 1999, our team has honed a strategy built on deep expertise and market insight. This foundation enables us to leverage our vast origination network and disciplined, agnostic approach to deal selection, giving us the luxury of choice and a market-leading edge.

By embracing what the market gives us rather than forcing outcomes, we’ve built a strategy that is as robust as it is resilient. This enduring commitment to quality and consistency is the essence of long-term success in private credit.

Toreigh Stuart

Managing Director