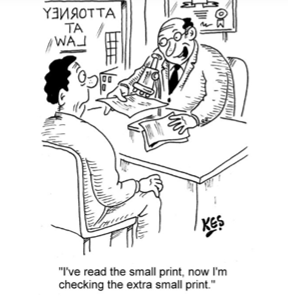

When Collateral Has Fine Print: What Contracts Really Tell Us

“A contractual right to bill is not the same as a contractual obligation to pay.”

– A great Greek credit philosopher (or perhaps just a seasoned lender we respect)

In private credit, that quote captures a truth we’ve lived with since our earliest days in the industry. With roots going back to 1999, we’ve seen more than our fair share of invoice-backed loans that looked airtight—until the contract behind the scenes told a different story.

At a glance, an invoice might look like a clear promise of payment. But in reality, invoices often rest on a deeper business agreement — the contract — that holds the real authority. And unless that contract is reviewed correctly and understood, what appears to be clean collateral can carry hidden risk.

The Quiet Risk Beneath the Surface

In asset-based lending, we regularly fund against accounts receivable. But here’s the nuance: those receivables may be governed by a contract with terms that can reduce, delay, or outright void our claim.

Whether it’s a formal document or embedded terms and conditions, the agreement between our client and their customer sets the rules of the game; sometimes, those rules aren’t on our side.

Here are a few examples we’ve seen repeatedly:

- Holdbacks: A clause that retains 10% of every invoice until the final project sign-off. That portion of our collateral? Contingent — and potentially unrecoverable.

- Liquidated Damages: Buried deep in the contract may be penalties for late delivery, missed milestones, or production interruptions. These can be broad, punitive, and weaponized in a liquidation.

- Insurance Requirements: If our client fails to maintain coverage outlined in the contract, the debtor may withhold payment, regardless of whether goods were delivered or services performed.

- Milestone or Progress Billing: Even when our client has the contractual right to bill, the debtor may hold back funds in a default or collect-out scenario if the project isn’t complete.

- Return Rights / Guaranteed Sales: Especially in retail, contracts may permit returns months after the sale. An invoice might show revenue — the contract may tell a different story.

Uncovering What the Invoice Doesn’t Show

Even without a formal contract, many large buyers impose extensive terms and conditions that act as de facto agreements. Vendors often accept these terms implicitly just to do business, but they can carry all the legal weight of a signed contract when things go sideways.

That’s why, when we’re underwriting, we ask one simple question:

“What does the contract allow the debtor to do—not just the client?”

Why This Matters for Investors

We’ve spent 25 years learning to ask the right questions before capital goes out the door. In private credit, underwriting isn’t just about financial statements or customer concentration. It’s about knowing where real risk lives — and controlling for it before it can erode capital.

This approach has allowed us to build a private credit portfolio that has never had a negative rolling 12-month return since inception. That resilience doesn’t happen by accident — it’s the product of relentless detail and structural awareness.

The Bottom Line

A contract is never just paperwork. It’s the foundation of the receivable, and it can either protect your investment or quietly undermine it.

Because as we’ve learned over decades:

A right to bill is only valuable if there’s no contract standing in the way of getting paid.