The Liquidity Advantage: What Investors Gain by Thinking Beyond Daily Access

At Garrington, we view liquidity not as a limitation, but as a strategic advantage when it’s planned, transparent, and aligned with the underlying tangible assets.

The question we often hear

“If I can sell a bond fund any day, why would I tie up capital in private credit even a little?”

A fair question. Liquidity feels safe. The ability to “click to sell” offers convenience, but relying solely on it may not be the most effective strategy.

That liquidity can come at a very high price to an investor.

What public-market liquidity really gives you, and what it doesn’t

Daily liquidity in public credit markets offers several advantages, including constant pricing, standardized disclosure, and ease of execution.

However, those advantages exist precisely because investors participate through the market, rather than directly with the borrower.

Is daily liquidity even real liquidity? “Stocks can drop 10%+ in a month, and greater than 50% in a downturn; high yield bonds can drop 7% in a month; approximately 20% in a downturn?

That pricing risk matters.

Why public credit investors are “one step removed”

In public credit, investors often access borrowers indirectly through securitized, tradable instruments issued into large, standardized markets.

Capital is deployed into pre-packaged obligations that were underwritten elsewhere by someone else at an earlier time.

What investors actually own are market-priced securities, not the underlying credit agreements or collateral themselves.

Returns in this environment are driven primarily by spread movement, duration management, and relative-value positioning factors that are as much about market sentiment as they are about underlying credit performance.

Liquidity comes from the ability to sell to another market participant, not from the repayment of the borrower’s obligation.

Even in investing, context matters. Liquidity has its place — but in private credit, the right kind of liquidity is planned, not impulsive. It’s about ensuring access that aligns with assets, not anxiety

By contrast, in private credit, particularly senior-secured and asset-based lending, capital is deployed at origination, and each facility is underwritten on a loan-by-loan basis.

Exposure is to the borrower’s real assets and contractual cash flows, not to the secondary market’s interpretation of them.

The return engine is focused on underwriting discipline and collateral realization, rather than trading efficiency.

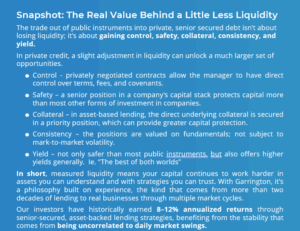

In short:

- Public credit provides market exposure and pricing transparency but also introduces market volatility.

- Private credit offers credit exposure, direct control, tangible collateral, and returns that derive from the performance of real borrowers, rather than market fluctuations.

That is what we mean when we say public-market investors are “one step removed.” Understanding this distinction, between market exposure and true credit exposure sets the stage for what truly defines private credit: proximity.

The value of proximity

In private credit, proximity creates perspective. Maintaining direct relationships with borrowers and intermediaries provides our credit teams with information asymmetry, offering a clearer and faster view of operating realities than public disclosure cycles can provide.

It also fosters collaboration: when conditions shift, disciplined lenders can work constructively with borrowers to protect collateral and preserve value, rather than waiting for markets to reprice risk.

That relationship-driven insight is one of the quiet advantages of private credit, and it’s what transforms liquidity planning from a theoretical exercise into an informed, hands-on discipline.

That proximity doesn’t just improve underwriting, it directly informs how we manage liquidity across the portfolio.

A boutique perspective on the liquidity advantage

For many accustomed to public-market immediacy, “less liquidity” feels uneasy, until they see what they gain:

- Direct exposure to real-economy businesses.

- Collateral they can understand and track.

- Returns that have historically compared favorably with almost any other investment asset class

At Garrington, we design every element of our liquidity framework around the assets we lend against, ensuring that investor access and portfolio management stay in harmony through all market conditions.