Opening the Books: Highlights from Our Q2 Investor Call

Transparency is more than a value; it is a practice. At Garrington, we host quarterly calls to open the books, share our thinking, and answer every question, because protecting capital is about more than strong numbers. It is about trust.

During our Q2 call, our leadership team, Toreigh Stuart, Tammy Kemp, and Erica Axani, walked investors through portfolio positioning, deal flow, and market dynamics. We also highlighted the discipline that has guided us through different cycles: lending against tangible assets, maintaining first-lien positions, and being willing to walk away from opportunities when the risk does not align with our standards.

Key Takeaways from the Call

- Portfolio Stability: Asset-based lending grew modestly, factoring adjusted slightly, and first-position security remained at 99%. Our geographic balance, with 70% U.S. and 30% Canada, held steady.

- Origination Discipline: We continue to review more than 100 opportunities each month, yet only close on a fraction. A recent example illustrated why: despite nearing final approval, we walked away from a transaction due to industry concerns and questions about borrower transparency. Protecting investor capital always comes first.

- Market Outlook: Instead of trying to predict rate moves or political outcomes, we focus on resilience. Our portfolio is structured to perform across cycles, with floating-rate pricing, conservative advance rates, and collateral that provides downside protection.

- Investor Engagement: Questions spanned interest rates, investor sentiment, tariffs, and deal flow in different market cycles. Each one reflected the healthy dialogue we want with our investors, the kind that challenges us and reinforces confidence in our strategy.

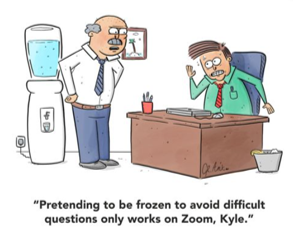

You won’t catch us freezing on a tough question. Investor calls are where openness matters most.

Why This Matters

Our calls are not just updates; they are part of an ongoing conversation. They demonstrate that investors have direct access to the people making decisions, and they underscore the discipline that has allowed us to build a diversified portfolio of approximately 150 loans while consistently targeting attractive, risk-adjusted returns.

At Garrington, we believe the best way to build trust is to be transparent, consistent, and accessible. If you would like to receive the link to the playback of our Q2 call, please reach out. We would be glad to share it.